If you are operating an online business but don't know where to start when it comes to tracking income and expenses,

you are in the right place!

You have put your blood, sweat and tears into your business and are starting to build momentum.

But you are feeling overwhelmed with how to manage your accounting. You want to make sure you are doing things right and don't want to leave your bookkeeping on the back burner.

The spreadsheets you are using to track your income and expenses can't keep up with your growing business.

You are struggling to record all of your PayPal or credit card transactions and know there must be an easier way.

You don't know how to create financial statements for your business or how to use reports to help with business decisions.

Or you have yet to make your first sale, but have accumulated several business expenses and want to create proper processes for tracking them.

You want to get control of your bookkeeping before it gets out of hand. You don't want to have to spend hundreds or thousands of dollars to have a bookkeeper clean up months or years of missing transactions.

What if there was a way to build your business and learn proper bookkeeping processes without spending hundreds a month on outside bookkeeping services?

You might be wondering...

Why can't I just wing it until I can hire a full time accountant?

How necessary is it to have accurate bookkeeping?

Can't I just focus on my business and figure out the numbers later?

I'm tracking my transactions in a spreadsheet, is that good enough?

But what if I told you...

You will save anywhere from $100 - $500+ a month on accountant fees by doing the bookkeeping yourself

With this course, you will learn how to track your business transactions accurately from the start, instead of spending hundreds - thousands having an accountant correct your financials down the road

By the end of this course, you will feel confident about your business numbers and what you provide for your tax returns

You have access to this course forever! So you can use it as a reference or training guide for future employees on your bookkeeping processes

In this course, you will learn how to use QuickBooks Online to keep track of your business transactions. No more manual spreadsheets that can't keep up with your growing business.

You will feel empowered to understand the numbers behind your business and be prepared for tax filings, feeling confident in what you are reporting.

Introducing...

The Startup Accounting Academy!

What exactly will you learn?

Why accurate accounting is necessary, different methods of bookkeeping, and accounting 101

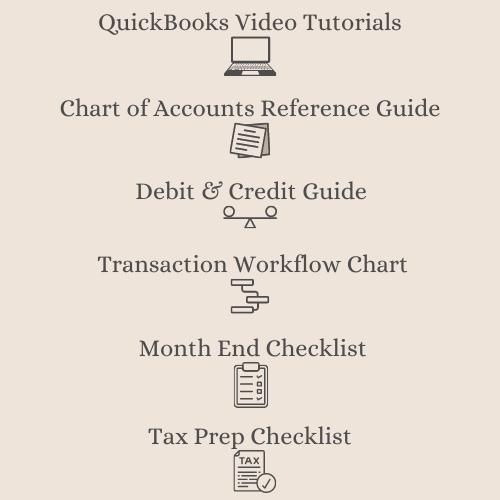

Step-by-step video guides of how to setup and use QuickBooks online as your accounting software

Detailed trainings of how to record all types of business transactions, from sales, to creating invoices, to paying bills all in one place

How to record credit card payouts from sources like Stripe, Square, and PayPal

How to create and understand financial statements

How proper accounting can help with business decision making

How to troubleshoot common bookkeeping errors

What tasks are necessary to do weekly, monthly and for tax prep

The Startup Accounting Academy is a self-paced, 100% online program that will help you build a successful online business by teaching you how to:

- Properly record your income and expenses

- Create and understand your financial statements

- Use your financials to analyze your business health

- Be prepared for tax season and feel confident in the numbers you are reporting

- Efficiently handle your bookkeeping so you have more time to spend on selling your services!

Your instructor:

Rachel Larsen

I have my Bachelors in Business Administration with a concentration in Accounting, am a Certified QuickBooks Proadvisor, and have over 10 years of industry experience as an accountant, working with startups and small businesses, helping to clean up their financials and set up their bookkeeping processes. I have seen first hand how setting up correct accounting processes help businesses see long term success.

Here's a look at the Startup Accounting Academy curriculum:

- QB - Setting Up Chart of Accounts (4:46)

- QB - Setting up & Reviewing Bank Feeds (10:52)

- QB - Bank Reconciliations (5:40)

- QB - Setting up Products & Services (5:14)

- QB - Recording Invoices & Deposits (10:14)

- QB - Recording Sales Receipts (4:32)

- QB - Recording & Paying Bills (8:05)

- QB - Recording Expenses & Checks (4:26)

- QB - Recording Credit Card Deposits (8:22)

- QB - Recording PayPal Deposits (7:41)

- QB - Journal Entries (7:23)

- QB - Balance Sheet (7:32)

- QB - Profit and Loss (6:15)

Plus hours of bonus materials

like...

Who is this course for?

Online Service Businesses

Online Course Creators

Business, Life, or Wellness Coaches

Marketing or Social Media Managers

Nutritional Therapy Practitioners

Photographers

Therapists

Interior Designers

Anyone whose earns income from services, online courses or consulting!

Don't wait until your books are a mess.

Enroll now to gain control of your business accounting and learn proper bookkeeping processes from the start! Your future self will thank you.

Frequently Asked Questions:

How long will I have access to this course?

You will have access to this course forever! You will be able to access it on any and all devices for an unlimited amount of time.

Why aren't there any lessons on taxes?

Taxes are a bit more complicated to provide a comprehensive lesson on that applies to all students. I am not certified in every state to be able to provide tax advice to everyone who purchases this course. Also, depending on your business legal type, personal financial goals, and numerous other reasons, tax advice can really differ dramatically. Any taxes discussed in this course are high level best practices to prepare for tax filings, so it is important to work with a licensed tax accountant.

Should I purchase this course if I sell products and do not provide services?

I focus my course on how to account for service based businesses, but there are so many topics discussed in this course that would benefit anyone with an online business. The main topic that is not covered that you would be missing out on is how to integrate your point of sale system with QuickBooks to record income. I would be happy to work with you 1-on-1 to get this set up properly.

What if I want a refund?

Due to the digital nature of this course, I do not offer refunds. Please be sure to review the course curriculum and message me (email: [email protected]) with any specific questions to make sure that this course is the right fit for you and your business before you purchase!

What countries does this apply to?

I am only educated on how to account for businesses located in the U.S. and am not sure what requirements are necessary for anyone outside of the U.S.

Enroll now!